Ghost Kitchens explained for HVAC industry – and why they’re here to stay

2022-02-16

Ghost Kitchens explained for HVAC industry – and why they’re here to stay

We know many ‘pandemic phenomena’ may have escaped your attention. Ghost Kitchens are probably one of them.

The commercial food industry, like so many others, has had to adapt to survive and thrive in the new landscape created by Covid.

And growing numbers of restaurants are reimagining themselves as Ghost Kitchens. They can be succinctly described as huge commercial kitchens designed for food delivery.

More specifically, they are purpose-built commercial facilities to produce food exclusively for delivery. They provide physical spaces for delivery-only food brands, which might be national or local, to rent out and create food for off-premises consumption – delivered by drivers or cyclists in the same manner as Deliveroo, Just Eat or Uber Eats.

There are no waiters, no dining areas, no shopfront. They come in different guises too: ‘crowd kitchens’, ‘dark kitchens’ or ‘delivery-only kitchens’.

They are booming in popularity – and S&P UK has been recently appointed to help to build one of the first Ghost Kitchens in Scotland.

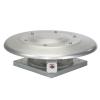

We have supplied 17 KABT kitchen extraction fans for the identified site – a warehouse that used to provide office spaces and manufacturing facilities historically.

The food delivery service market in the UK grew from £8.5bn in 2019 to £11.4 billion in the UK in 2020, the latest figures show. It has doubled since 2015.

Sales Director Lee Page said: “We are very excited to be supporting the creation of what we believe is Scotland’s first-ever Ghost Kitchen, which is set to be built later in 2022.

“We have a proven track record of specifying for the commercial kitchen industry with our wide product range and providing world-class ventilation for restaurant chains and owners.

“The evolution of the Ghost Kitchen, which began life in pre-pandemic times in the US and Asia and is now spreading across the UK and Europe, has no doubt been accelerated by Covid. Some restaurants were forced to shut their doors for good but have relaunched as Ghost Kitchens with lower costs and overheads and an exponentially growing target market.

“There was a 39% increase in UK food deliveries in the three years to 2020. As a result, many delivery services have prospered and those creating the food have risen to the challenge with gusto despite the pain of the last couple of years.”

Many experts within the food industry believe Ghost Kitchens will remain a permanent fixture, even as the pandemic begins to wind down. Indeed, market research firm Euromonitor predicts Ghost Kitchens could be a $1 trillion industry by 2030.

Lee added: “We are aware of interest and plans to develop more Ghost Kitchen sites around the UK and can’t see this appetite dwindling any time soon. The sector is booming.”

Are you working on Ghost Kitchen plans? Contact the team to get your needs specified.

Bathroom Extract Fans

Bathroom Extract Fans Air Handling Units

Air Handling Units In-line Duct Fans

In-line Duct Fans Heat Recovery Units

Heat Recovery Units Acoustic Cabinet Fans

Acoustic Cabinet Fans Roof mounted fans

Roof mounted fans Comfort Cooling Range

Comfort Cooling Range Hand and Hair Dryers

Hand and Hair Dryers  Air Purifiers

Air Purifiers Plate Mounted Axial Flow

Plate Mounted Axial Flow  Cylindrical Cased Axial Flow Fans

Cylindrical Cased Axial Flow Fans  Centrifugal Direct Drive Fan

Centrifugal Direct Drive Fan  Parking Ventilation

Parking Ventilation  Smoke Extract Fans

Smoke Extract Fans  Atex Fans for Explosive Hazardous

Atex Fans for Explosive Hazardous  Heating Industrial Range

Heating Industrial Range  In-line Duct Fans

In-line Duct Fans Acoustic Cabinet Fans

Acoustic Cabinet Fans Roof mounted fans

Roof mounted fans Atex Fans for Explosive Hazardous

Atex Fans for Explosive Hazardous  Wall or Window Extract Fans

Wall or Window Extract Fans Whole house Extract Units

Whole house Extract Units Kitchen Extract Fans

Kitchen Extract Fans  Kitchen Extract Hoods

Kitchen Extract Hoods  Backward curved centrifugal fans

Backward curved centrifugal fans High pressure centrifugal fans with backward curved impeller

High pressure centrifugal fans with backward curved impeller High pressure centrifugal fans with forward curved impeller

High pressure centrifugal fans with forward curved impeller Centrifugal fans with forward curved impeller

Centrifugal fans with forward curved impeller Double inlet centrifugal fans

Double inlet centrifugal fans Radial Centrifugal fans for transportation of materials

Radial Centrifugal fans for transportation of materials Centrifugal fans for furnace applications

Centrifugal fans for furnace applications Mounting Accesories

Mounting Accesories  Electrical Accessories

Electrical Accessories